JULY 23, 2025 | ESG, SUSTAINABILITY, ENERGY OPTIMIZATION AND MONITORING, GREEN BUILDING PRACTICES

Digital transformation is no longer optional—it’s essential. To accelerate this shift, the Malaysian government is offering the Automation Capital Allowance (Automation CA)—a powerful tax incentive designed to reward companies that invest in automation and Industry 4.0 technologies. This blog breaks down what the incentive is, who qualifies, and how your business can benefit—with support from Tanand Technology.

What Is Automation CA—and Why Should You Care?

The Automation Capital Allowance (Automation CA) is a tax incentive provided by the Malaysian Investment Development Authority (MIDA). It offers a 200% capital allowance on eligible automation-related expenditures, allowing businesses to claim up to RM10 million per year from 2023 to 2027.

Key Benefits:

- Double tax deduction (200%) on qualifying CAPEX

- Covers automation equipment, systems, and digital solutions

- Applicable to both manufacturing and selected service sectors

- Drives productivity, reduces reliance on manual labour, and supports ESG goals

Who Is Eligible? Key Criteria to fulfill Before Applying For The Government Incentive

To qualify for the Automation CA, companies must meet the following basic eligibility criteria:

| Requirement | Criteria |

|---|---|

| Malaysian Company | Incorporated under Companies Act 2016 |

| Operation Longevity | Operational for at least 36 months |

| Sector | Must be in manufacturing or selected services (e.g., logistics, healthcare, facilities management) |

| Digitalization Focus | Project must involve automation or Industry 4.0 tech |

| CAPEX | Up to RM10 million on qualifying assets |

| Tech Component | Must include at least one Industry 4.0 element (IoT, AI, cloud, etc.) |

| Outcomes | Must improve productivity, reduce labour, or enhance quality |

| No Double Claims | Not claiming similar incentives (e.g., RA, ITA) in the same YA |

Use Cases: What Kind of Projects Qualify for Incentives?

Services Sector Examples:

- Logistics & Warehousing: RFID inventory tracking, automated sortation

- Healthcare: Smart ward monitoring, energy control systems, IoT ward monitoring

- Facilities Management: IoT fault detection, predictive maintenance

- Hospitality: HVAC optimization, room automation

- Retail/F&B Chains: Kitchen automation, cold chain IoT monitoring

Manufacturing Sector Examples:

- F&B: IoT temperature tracking, automated filling lines

- Electronics: AI-based defect detection, test handlers

- Automotive: Robotic assembly, smart material handling

- Textile: Smart conveyors, machine health monitoring

- Paddy Processing: IoT-based drying control, smart silos

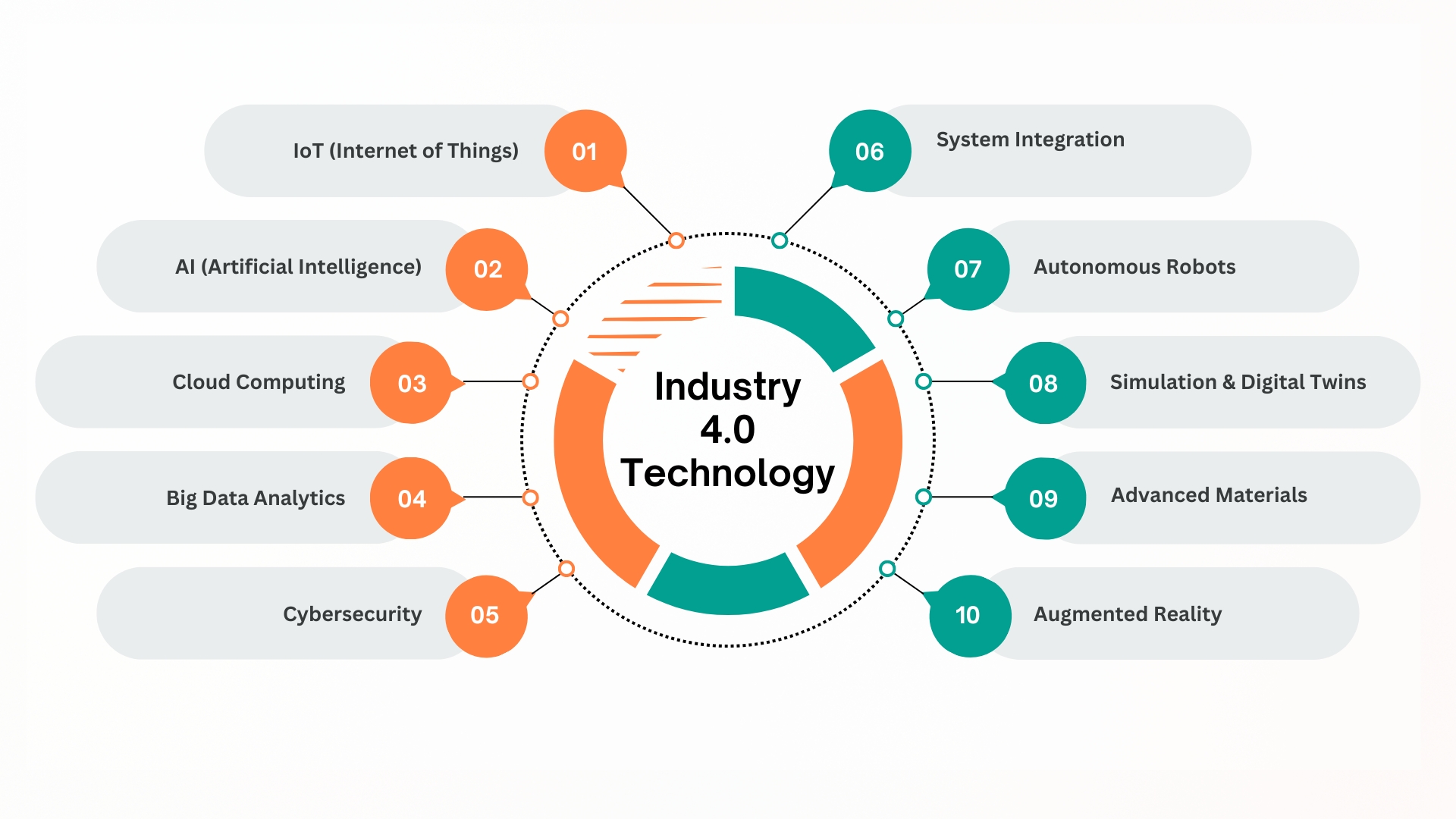

What Counts as Industry 4.0 Tech?

Your system must use at least one recognized Industry 4.0 technology. These include:

☑️ Tanand’s solutions check many of these boxes—making them perfect for Automation CA claims

How Tanand Technology Helps You Maximize Benefits

Tanand provides turnkey digitalization and automation services for both manufacturing and service-based companies. Our solutions are built with compliance and eligibility in mind, making it easier for you to claim Automation CA.

Our Core Offerings:

- IoT sensor deployment for real-time asset tracking and energy management

- Smart BACS automation for pumps, chillers, AHUs, FCUs, etc.

- AI-driven HVAC and process optimization

- Energy Management Systems (EMS) with dashboards and analytics

- Predictive Maintenance and integration with CMMS

We don’t just deploy solutions—we help you unlock tax savings through smart automation.

Understanding How The Incentive Calculation Works

Let’s say your business invests RM1 million in Tanand’s digital solution. Here’s how the tax savings add up:

| Item | Amount |

|---|---|

| CAPEX Spending | RM1,000,000 |

| Automation CA (200%) | RM2,000,000 |

| Tax Saving @ 24% | RM480,000 |

Let’s look at how the incentive breakdown in two years :

| YA | Claimed CAPEX | CA (200%) | Tax Saving (24%) |

|---|---|---|---|

| 2025 | RM500,000 | RM1,000,000 | RM240,000 |

| 2026 | RM500,000 | RM1,000,000 | RM240,000 |

That’s nearly half a million saved – while improving your operations.

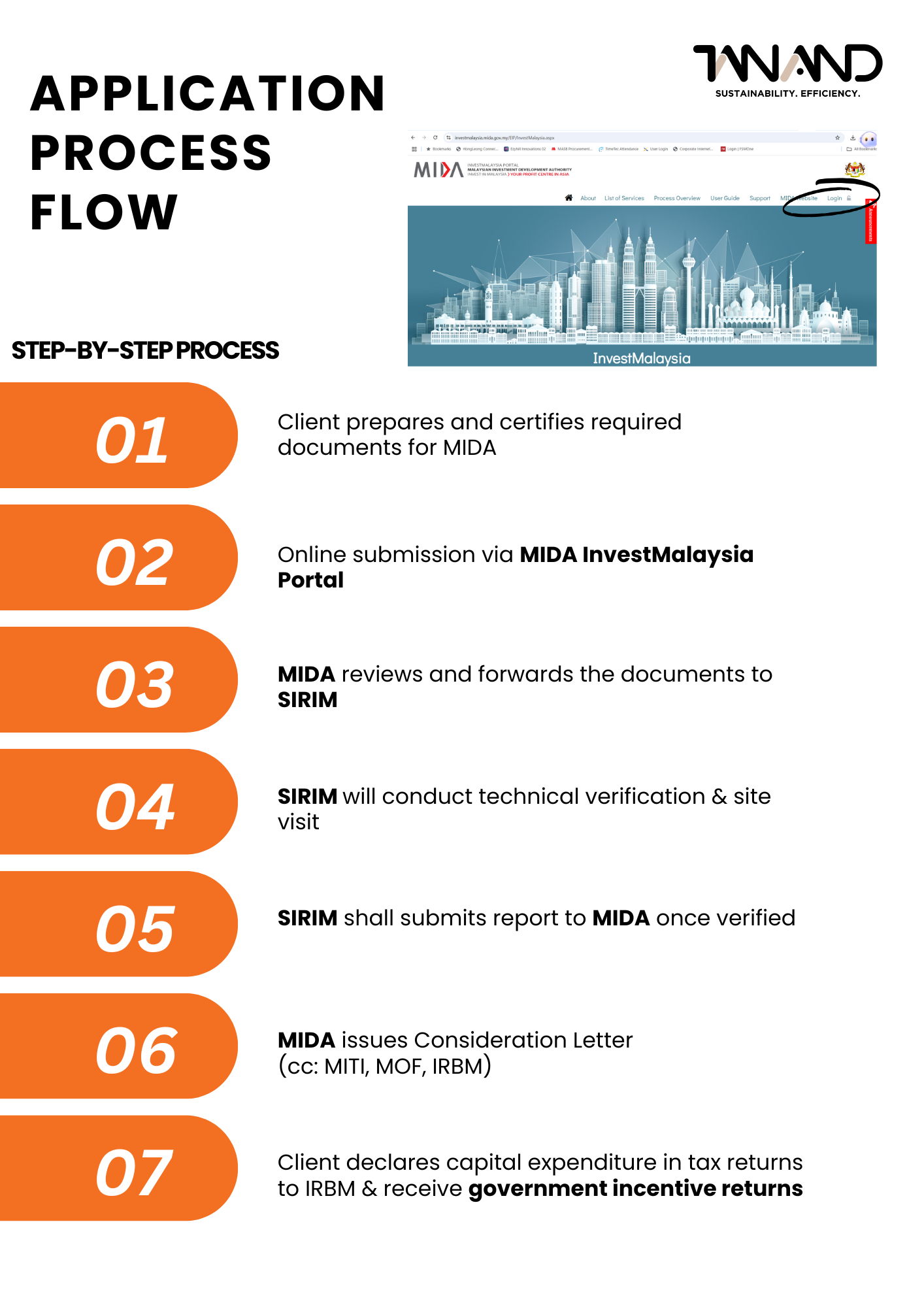

How Does The Application Process Looks Like

For more information about the Government Tax Incentive

– Click Here –

Here’s a simplified checklist of what’s required:

🔘Business License

🔘Manufacturing License / MIDA Exemption Letter

🔘Certified documents (equipment list, POs, invoices, payment proof)

🔘Technical proposals and system diagrams

🔘MIDA application through InvestMalaysia portal

🔘SIRIM site visit for technical verification

Tanand will guide you through the documentation and submission process. So sit back, and let’s digitize your business for better tax savings and stronger ROI

Conclusion: Turn Your Automation Into Tax Savings

If your company is planning to modernize operations or adopt Industry 4.0, the Automation CA is your chance to get rewarded for doing the right thing. With Tanand Technology as your partner, you can deploy smart systems and claim your tax benefits with full confidence.

Ready to digitize and save? Reach out to our team to assess your eligibility and project fit at our contact page to speak with our technical experts.

Frequently Asked Questions

The Automation CA is a government tax incentive offering 200% capital allowance on qualifying automation and Industry 4.0 investments in the manufacturing and services sectors.

Malaysian-incorporated companies operating for at least 36 months in eligible sectors (e.g., manufacturing, logistics, healthcare) and investing in automation or digitalisation projects.

Technologies must include at least one Industry 4.0 component, such as IoT, AI, cloud computing, big data analytics, or robotics.

Companies can claim up to RM10 million per year of assessment, with potential tax savings of up to 24% of the approved 200% capital allowance amount.

Tanand offers compliant digitalisation solutions and supports clients in system design, documentation, and application submission to MIDA and SIRIM.

Required documents include business licenses, certified equipment lists, invoices, technical proposals, proof of payment, and a SIRIM verification request.